This is why everyone needs to have an excellent credit score.

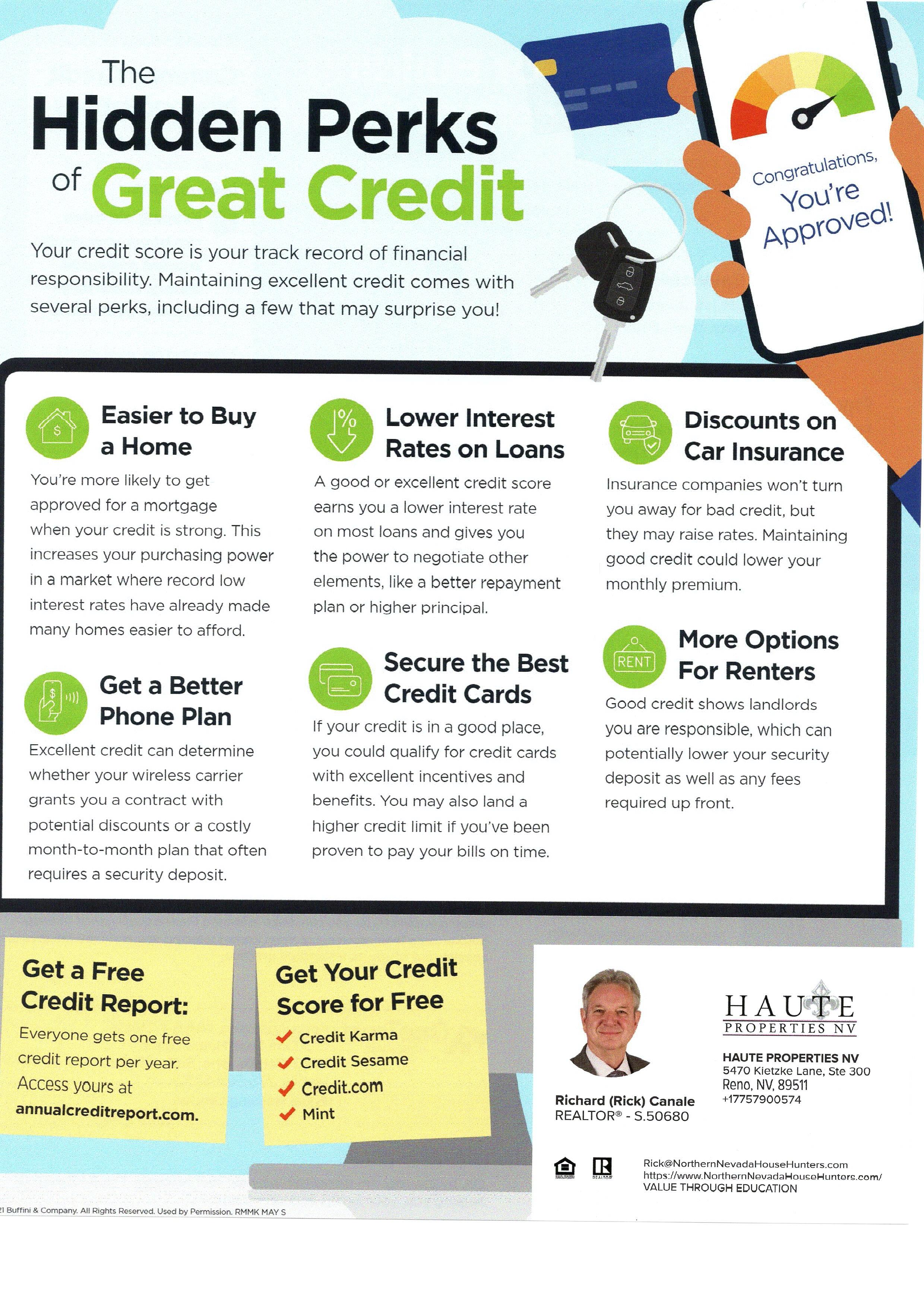

What are the perks of having great credit? For one thing, it’s easier to buy a home. You’re more likely to get approved for a mortgage if your credit score is strong. It also increases your purchasing power in a market where interest rates have already made many homes easier to afford.

Speaking of which, the second perk is that you can get a lower interest rate on your loan. This gives you the ability to negotiate other elements such as a better repayment plan or higher principal.

“You’re more likely to get approved for a mortgage if your credit score is strong.”

That said, how do you obtain and maintain great credit? First, make your payments on time. Your payment history is the largest part of your FICO score (about 35%). Second, keep your balances low. Aim to use less than 20% of your credit limit.

If you’d like to know more about the perks of great credit or have any other real estate questions, don’t hesitate to reach out to me. I’d love to hear from you.