One Trust Home Loan’s recast option helps sellers avoid making contingent offers.

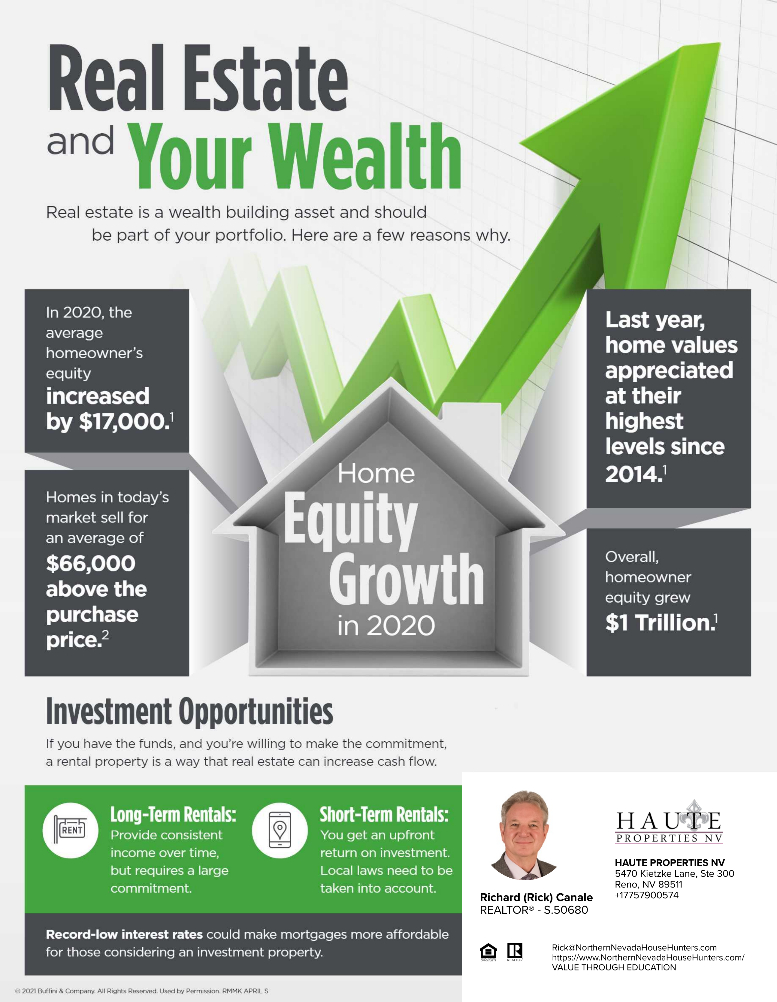

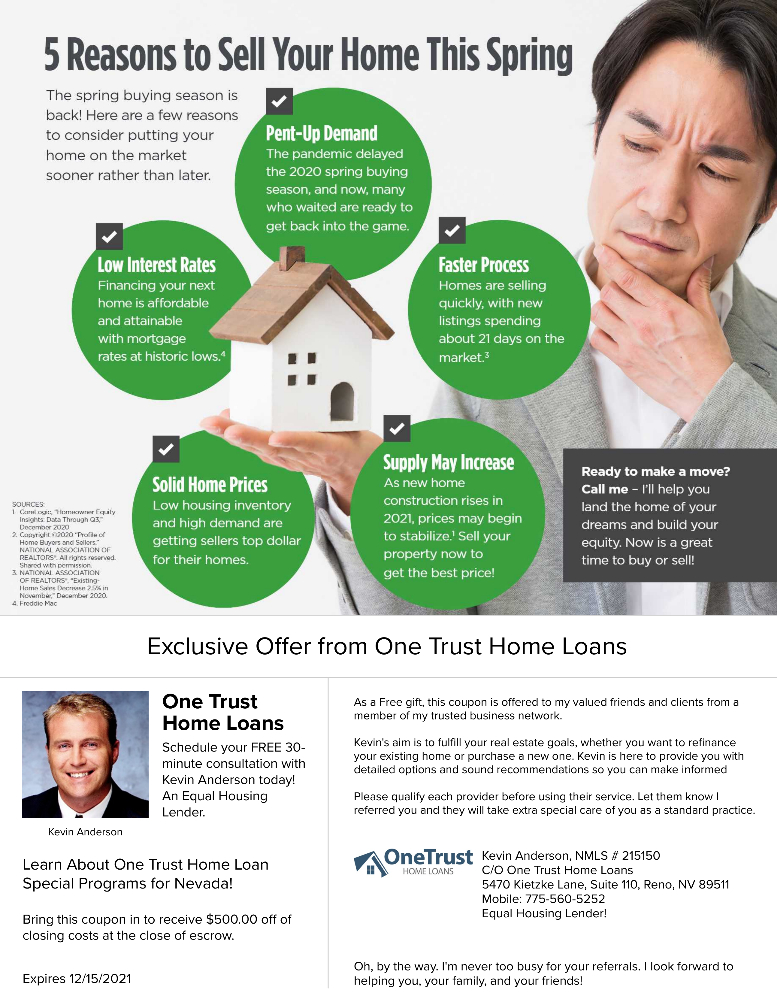

Many home sellers in today’s market are finding themselves in a pretty tough conundrum: They need to get the equity out of their current home to be able to buy a new one, but they also understand that a contingent offer is a losing strategy. Is there a better way to position yourself for success in this fast-paced market of ours? Thankfully, there is. Joining me today is special guest Kevin Anderson from One Trust Home Loans, who will explain the core benefits of their recast option. For a minor fee, this option affords you major leverage.

Cited below for your convenience are timestamps that will direct you to various points in the video. Feel free to watch the full message or use these timestamps to skip to topics that interest you most:

0:57 — Kevin provides an overview of One Trust Home Loans’ unique recast option, which can be applied to any conventional loan

1:28 — Why contingent offers are often given lower priority

2:05 — The net equity from your home sale can be applied toward your new house; One Trust will then recast your principal and interest payment

3:00 — How a recast significantly bolsters your offer

4:03 — Will you get saddled with two separate mortgage payments?

4:37 — How the recast option differs from a bridge loan

5:11 — Wrapping up today’s topic

Hopefully, you found our conversation to be insightful. If you ever have any real estate questions, call or email me. I would love to help you.